One of the markers of progress we utilize with our annual Leaderboard is tracking how automakers are advancing the decarbonization of the steel and aluminum they use to produce vehicles. Automakers have the purchasing power to drive steel and aluminum producers to decarbonize their manufacturing processes, as some of the biggest industrial consumers of those metals.

If all the automakers we track were to commit to using 100% fossil-free steel and aluminum within ambitious timeframes, and set up advance purchase agreements with suppliers to buy it, steel and aluminum producers would respond by moving away from polluting, fossil fuel-dependent manufacturing processes and rapidly adopt emerging green steel and aluminum production technologies.

If the steel and aluminum industries were to decarbonize, under pressure from vital customers such as automakers, the impact on our climate would be enormous. Decarbonizing steel and aluminum production worldwide would reduce climate-altering emissions three times as much as taking every single plane out of the sky. Without rapidly accelerating the decarbonization of steel and aluminum production, climate experts estimate that we will not be able to stay under 1.5 degrees of warming, a critical benchmark for human and environmental health.

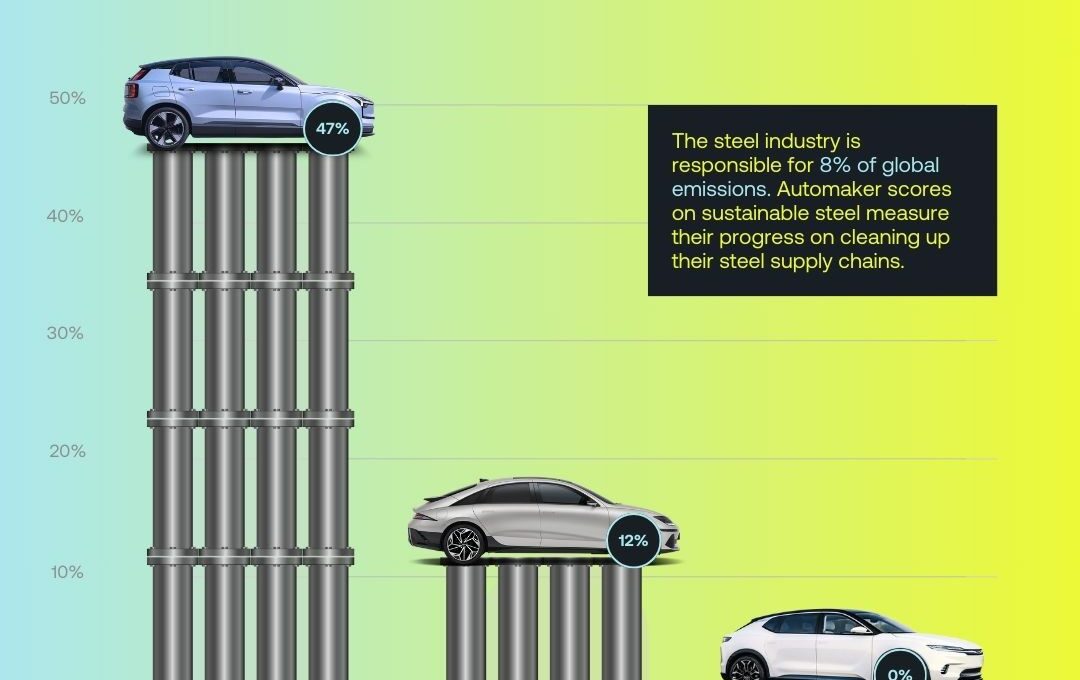

The 2024 Leaderboard found notable progress on steel and, to a slightly lesser extent, aluminum decarbonization. In 2023, over half of automakers scored 0% on steel and over three quarters scored less than 10%. But in 2024, this reversed: two thirds of automakers have now taken initial steps on steel decarbonization. Pressure from civil society (like the recent SteelZero initiative from Climate Group), investors, and regulators over the past few years has likely helped put steel decarbonization on the agenda for automakers, with tangible results.

Movement on disclosing emissions from steel helped to fuel Tesla’s ascent from joint last place last year to the third spot in 2024. The jump was due entirely to the progress that the company has made regarding its scope 3 emissions disclosures. In an industry first, Tesla is now the only company to disclose disaggregated GHG emissions specifically for its steel supply chain. The company discloses that steel emissions constitute 8% of its Scope 3 emissions for categories 1 (purchased goods and services) and 4 (upstream logistics).

Volvo remains the industry leader for clean steel, scoring 49% in that category, nearly double the score of second place Mercedes (25%). The gap in aluminum sourcing was closer with Volvo edging Mercedes by 5%.

GM and Ford also achieved significant score increases on steel, jumping from 0% to 17%. GM and Ford’s improvements came on the back of better target setting for fossil-free steel: both companies are now members of the First Movers Coalition’s sector group on steel and have accordingly set targets to ensure that at least 10% of all their steel purchased per year will be near-zero emissions by 2030. The automakers also scored points for entering into formal agreements with suppliers to incentivize investment in fossil-free steel.

East Asian automakers, however, are falling behind: with Honda, Toyota, BYD, GAC and SAIC all scoring 0%. Hyundai and Kia also scored very low – having made minimal progress on recycled steel and aluminum, but no progress on decarbonizing the primary steel and aluminum used in their vehicles.

With companies scoring an average of just 11% on the steel indicators, there is still much room (and need) for improvement. Only Volvo and Geely scored points for setting targets to increase the amount of recycled steel used in their vehicles. Very few automakers collaborate with key multi-stakeholder initiatives (SteelZero, First Movers Coalition, and ResponsibleSteel) to drive greater production of fossil-free and environmentally responsible steel: GM, Ford, Volvo, and Mercedes were the only automakers to have joined these initiatives.

To meet the scale of the climate challenge we face, automakers need to accelerate efforts on green steel and aluminum. By doing so, they have the opportunity to distinguish themselves as leaders on climate – for the cost of only $100-200 per vehicle.