A new report from Greenpeace East Asia (GPEA) found that the world’s leading manufacturers of EV batteries lack clear goals and commitments to decarbonize their supply chains.

This matters because battery manufacturing is responsible for roughly one-third of cradle-to-gate CO₂ emissions for new electric vehicles. Electricity use for battery manufacturing and the production of cathode materials are the two largest drivers of emissions in battery manufacturing, yet most battery makers lack targets for one or both. CATL, LG Energy Solution, and Panasonic Energy are the only companies among the top ten in the report to have set both 100% renewable electricity targets for their operations and supply chain emissions reduction goals.

Tesla provides a real-world example of disclosing emissions from cathode production

GPEA found that for lithium iron phosphate batteries (LFP), cathode production accounts for 29.41% of the total carbon footprint of battery supply chains. For NMC (lithium nickel manganese cobalt oxide) batteries the percentage of emissions from cathode production ranges from 38.28% all the way up to 57.71%, depending on the nickel content.

Right now Tesla is the only automaker disclosing this level of detail about their supply chain emissions, so it’s worth looking closely at the information in their 2024 impact report, which provides a real-world case study of the estimates from GPEA.

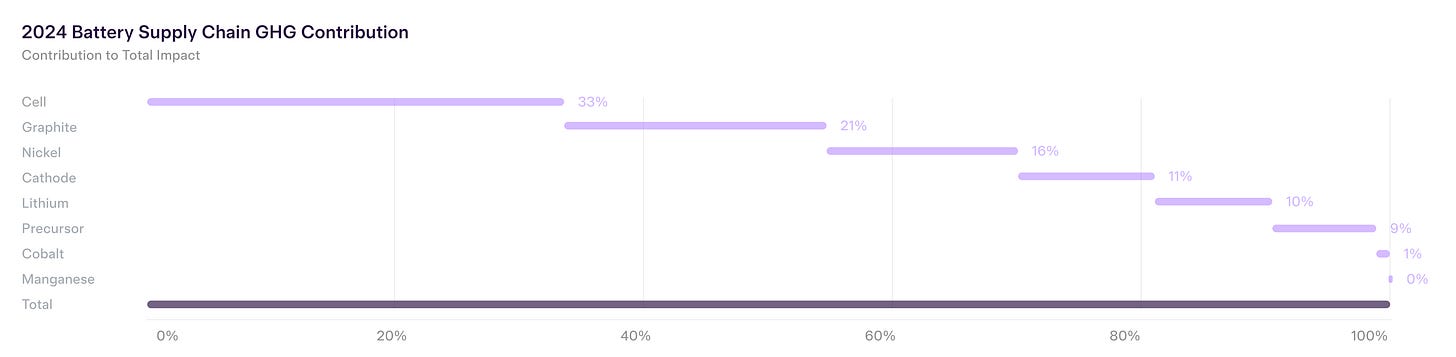

From Tesla’s 2024 impact report

As we can see above, Tesla attributes 38% of its overall battery supply chain emissions to cathode production, including both the section listed as ‘cathode’ as well as mining and refining of nickel, lithium and cobalt. GPEA’s analysis estimated that cathode production for LFP and NMC batteries accounts for 29% – 57% of total battery supply chain emissions, which makes sense given that Tesla uses a combination of LFP and NMC batteries. Tesla’s real-world disclosure of emissions from its LFP and NMC batteries sits right in the middle of the estimated range from GPEA for the same battery types.

It’s also worth noting that graphite is also a big contributor to total emissions from Tesla’s battery supply chains, weighing in at 21% of the total. This reinforces GPEA’s recommendations that automakers focus on sourcing low-carbon materials.

Overall, Tesla’s disclosures add further weight to GPEA’s recommendations – namely that auto and battery makers work together to increase the share of clean energy in their shared supply chains, as well as procuring low-carbon materials.

Chinese companies race to battery decarbonization

One thing that stands out from the report: CATL’s progress on battery decarbonization shows what is possible for Chinese battery makers, and highlights BYD’s lack of action. CATL is also pulling ahead of major Korean battery makers – Samsung SDI and SK On both performed very poorly according to GPEA’s analysis.

CATL is:

❎ Setting net-zero targets encompassing their entire value chain by 2035.

💯 Aiming for 100% zero-carbon electricity in its core operations by 2025, and reporting on the adoption of zero-emission electricity: rising from 22.00% in 2021 to 74.51% in 2024.

🥉 Disclosing their Scope 3 emission data, including a breakdown of Scope 3 Category 1 emissions (from purchased goods and services.)

In contrast, BYD has not disclosed carbon reduction targets covering their supply chain, and is one of three companies including EVE and Sunwoda that are not reporting their scope 3 emissions data. Despite BYD’s commitments to achieving net zero across the value chain by 2045, the company has been silent about their specific targets for reducing emissions from their supply chain.

How auto and battery makers can work together to decarbonize battery production

Greenpeace East Asia is calling on battery manufacturers to:

☀️ Report regularly on their use of renewable electricity

🎯 Set strong targets for reducing supply chain emissions

♻️ Increase the use of recycled materials

“Battery manufacturers must publish regular progress reports on their adoption of renewable electricity, and should set targets for reducing supply chain emissions and the use of recycled materials. By rapidly transitioning to renewable electricity, battery makers can shrink the carbon footprint of their products and cement their role in the low-carbon transition.”

-Greenpeace East Asia campaigner Erin Choi

Setting public targets for decarbonization will strengthen the competitive edge of battery manufacturers in a market where automakers are under growing pressure to cut emissions across their supply chains. Automakers can help drive progress by urging their battery manufacturers to switch to renewable energy and build more circular battery supply chains.