As the world continues to shift to renewable energy systems and electric vehicles, which are key to achieving climate neutrality by 2050, ensuring sustainable and responsible battery supply chains is vital.

The EU Batteries Regulation due diligence rules, if implemented correctly, will be a turning point for green and ethical batteries. Under these rules, companies will need to identify, mitigate and account for human rights, environmental and climate change impacts in lithium, nickel, cobalt and graphite supply chains of batteries found on the EU market. With the rules due to enter into force in August, and at a time of increased pushback against sustainability requirements, now is the time to keep ambition high, and not lower the bar.This briefing takes a look at carmakers’ implementation of the EU Batteries Regulation due diligence rules to date, showcasing best practice examples and areas for improvement. The analysis, whilst not exhaustive, relies on publicly available data and builds on T&E’s Pedal to the Metal study 二 Lead the Charge’s Leaderboard results. It finds that:

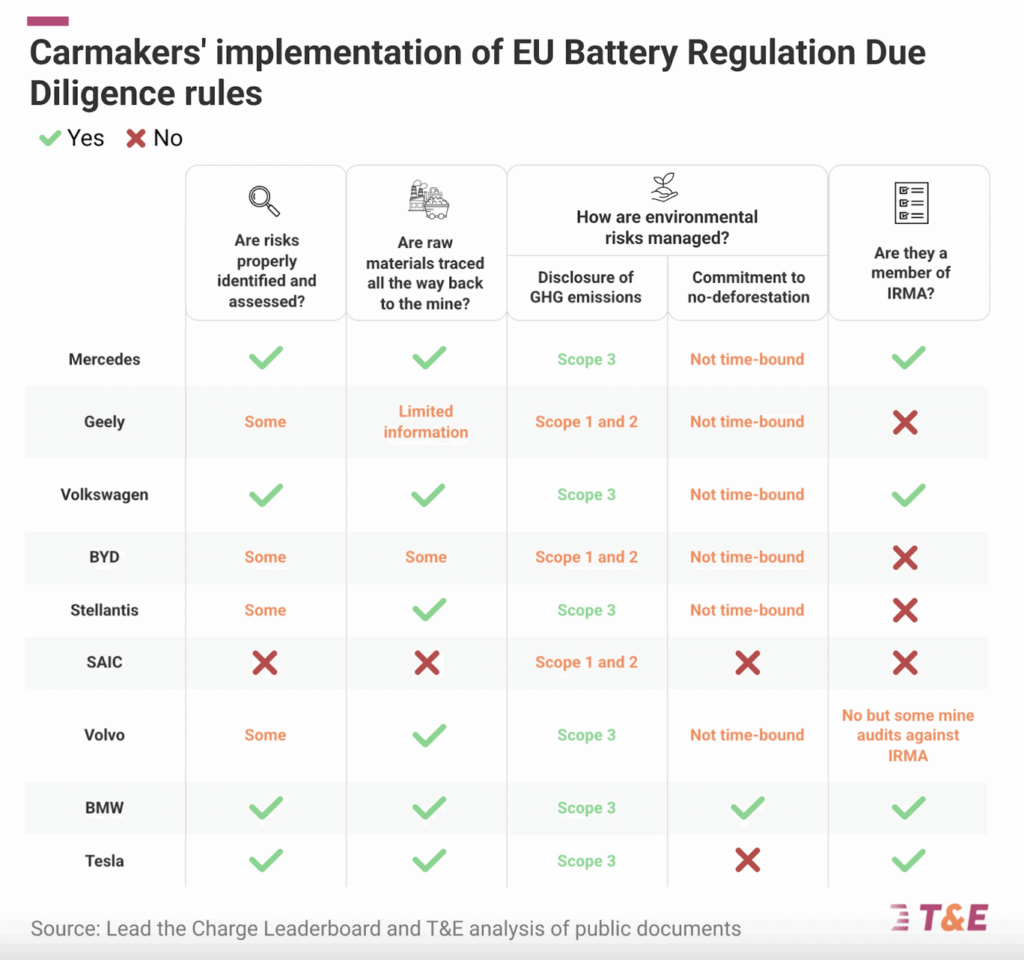

- Overall, progress is being made. OEMs have started rolling out supply chain policies and transparency measures, preparing to meet the due diligence requirements. For example, whilst not all automakers are assessing all the necessary risks, the majority have some form of risk assessment in place. The key now will be to ensure that all risks are being assessed throughout entire supply chains in order for a comprehensive risk mitigation to take place.

- When looking at how individual environmental risks are mitigated, there has also been some progress across different actions. There has been significant progress in disclosing greenhouse gas emissions, with the majority of carmakers disclosing total scope 3 GHG emissions.

- Headway has also been made in implementing traceability systems. Whilst not all carmakers are tracing their battery minerals all the way back to the mine, a majority have some form of system in place.

- Nevertheless, gaps remain. Whilst carmakers have general policies on deforestation in their supply chains, only one has a concrete, time-bound commitment. In addition, whilst carmakers generally disclose their own water usage, they don’t disclose water usage by suppliers. Progress in these areas would support risk mitigation.

- Finally, European automakers are much more advanced in their preparedness compared to Chinese OEMs, with European companies such as BMW and Mercedes, leading across numerous due diligence requirements, such as risk identification and assessment and supply chain traceability.

It is therefore more important than ever for the European Commission to get implementation right. T&E calls on the European Commission to:

- Keep the primary text of the battery regulation due diligence provisions and refrain from any weakening of the obligations, focusing on pure reporting simplification.

- Finalise the guidelines for implementation of the due diligence requirements, according to best practice and in line with existing international standards, before entry into force of the rules, whilst ensuring notified bodies across all Member States are in place to verify compliance.

- If delaying the rules is unavoidable, it should be a delay of no more than 1 year.

Establish robust and targeted criteria for recognising due diligence schemes, as foreseen under the Regulation. The criteria must ensure schemes can only be recognised if they demonstrate full alignment with the regulation.